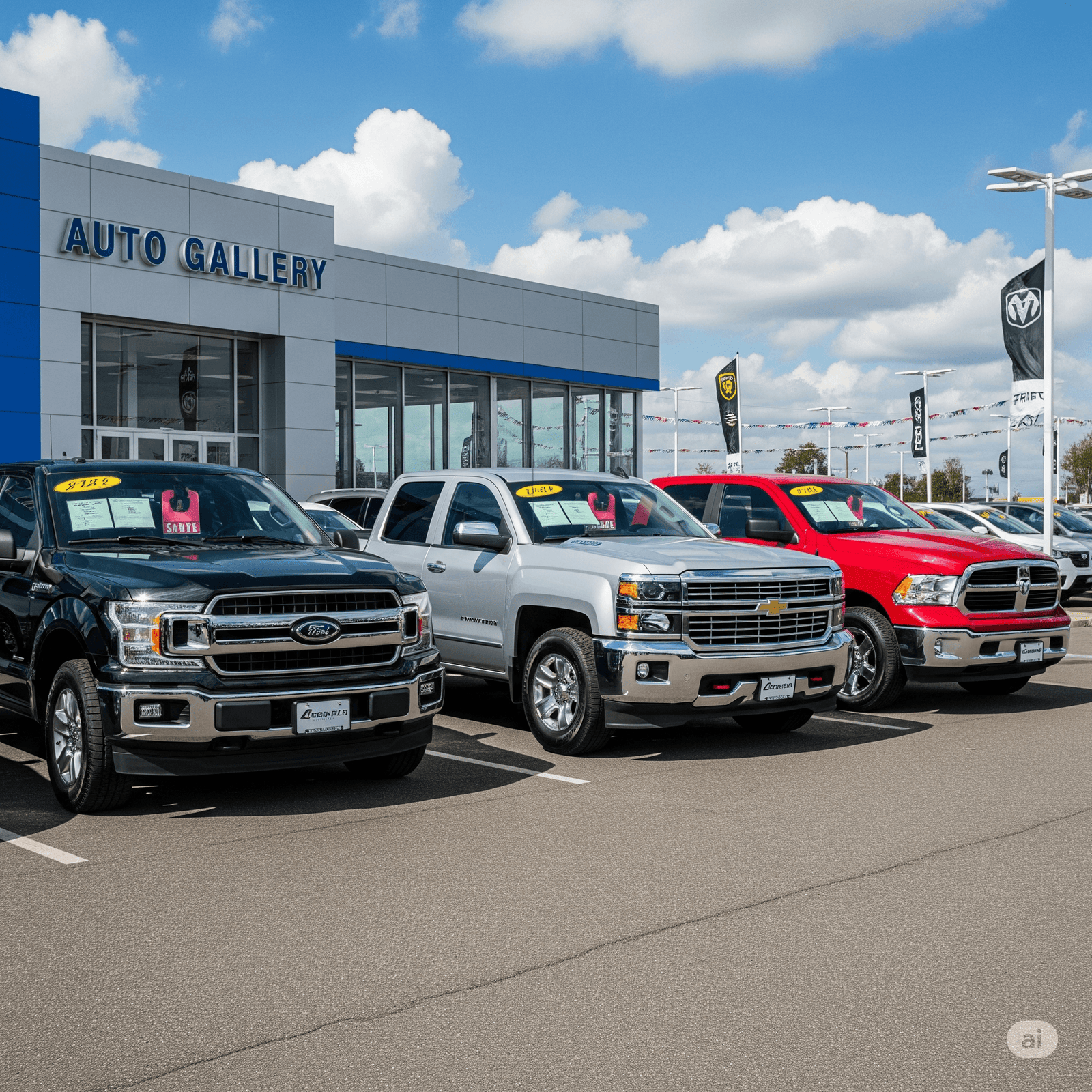

Pickup trucks have become the backbone of American roads, combining rugged capability with modern luxury. Whether you need a workhorse for your business, a family hauler with ample space, or an adventure-ready companion for weekend getaways, today's pickup trucks offer unparalleled versatility. The good news? Financing these powerful machines has never been more accessible.

🔥 Why 2024 is the Best Year for Truck Financing:

- Record-low interest rates from manufacturers' financing arms

- Increased competition among lenders driving better terms

- Strong resale values making banks more willing to lend

- More $0 down payment options than ever before

🏆 Top Financing Deals on Popular Pickup Models

The Ford F-150 continues its 40+ year reign as America's best-selling vehicle, and for good reason. With its perfect blend of power, technology, and comfort, it's no wonder financing deals are competitive. Qualified buyers can secure:

👉 $0 down with payments as low as $450/month for 72 months

👉 Special APR as low as 2.9% through Ford Credit

👉 Bonus: $1,000 retail customer cash on select models

🚀 Explore All Truck Financing Options →The Chevrolet Silverado 1500 and its upscale sibling, the GMC Sierra, offer compelling alternatives with their refined interiors and innovative features. Current promotions include:

👉 $499/month lease with $2,999 due at signing

👉 0% APR for 36 months on select models

👉 $1,500 bonus cash for current competitive lessees

💸 Finance Silverado 2022 From $83 →💡 Smart Financing Strategies for Pickup Trucks

1. Consider longer loan terms carefully: While 84-month loans lower payments, you'll pay more interest overall. Ideal if you plan to keep the truck long-term.

2. Check credit union rates: Local credit unions often beat bank rates by 0.5-1.5% for well-qualified buyers.

3. Time your purchase: End of month, quarter, and year often bring additional incentives as dealers meet sales targets.

4. Look for package deals: Some dealers offer free maintenance packages or extended warranties with financed purchases.

📊 Average Monthly Payments by Truck Class:

Mid-size trucks (Tacoma, Colorado, Ranger): $425-$550/month

Half-ton trucks (F-150, Silverado, Ram 1500): $475-$650/month

Heavy-duty trucks (F-250, Silverado 2500HD): $600-$850/month

*Based on 72-month loans with good credit (700+ FICO)

The Ram 1500 stands out with its luxurious interior and smooth ride. Current financing highlights include:

👉 $383/month for 36 months with $4,999 down

👉 1.9% APR for qualified buyers

👉 $1,000 bonus cash for returning Ram customers

🔧 Finance Ram 1500 2016 From $383 →🔍 Used Truck Financing: Hidden Gems

Pre-owned pickups offer tremendous value, with many 3-5 year old models retaining excellent reliability. Banks typically offer:

👉 Lower rates for late-model used (1-3 years old) versus older models

👉 Shorter terms (usually max 60 months for trucks over 5 years old)

👉 Higher down payments often required (typically 10-20%)

Pro tip: Consider certified pre-owned (CPO) programs from manufacturers, which often include extended warranties and special financing rates.

✅ Final Checklist Before Signing Your Truck Loan

Before driving off in your new pickup, ensure you've:

1. Compared at least 3 financing offers (dealer, bank, credit union)

2. Verified all rebates and incentives are applied

3. Understood all fees (documentation, acquisition, etc.)

4. Confirmed the loan term matches your ownership plans

5. Checked for prepayment penalties (rare but worth confirming)

With the right financing strategy, your dream pickup truck is more affordable than you might think. The combination of strong resale values, competitive lending environment, and manufacturer incentives creates the perfect storm for truck buyers in 2024.

🚛 Start Your Truck Financing Journey Today →